You’ve taken the time to plan for the future and create your estate plan. After working with a Chicago estate planning attorney to make sure all assets are accounted for and all contingencies are covered, you’re feeling the satisfaction of a job well done.

(Article continues below Infographic)

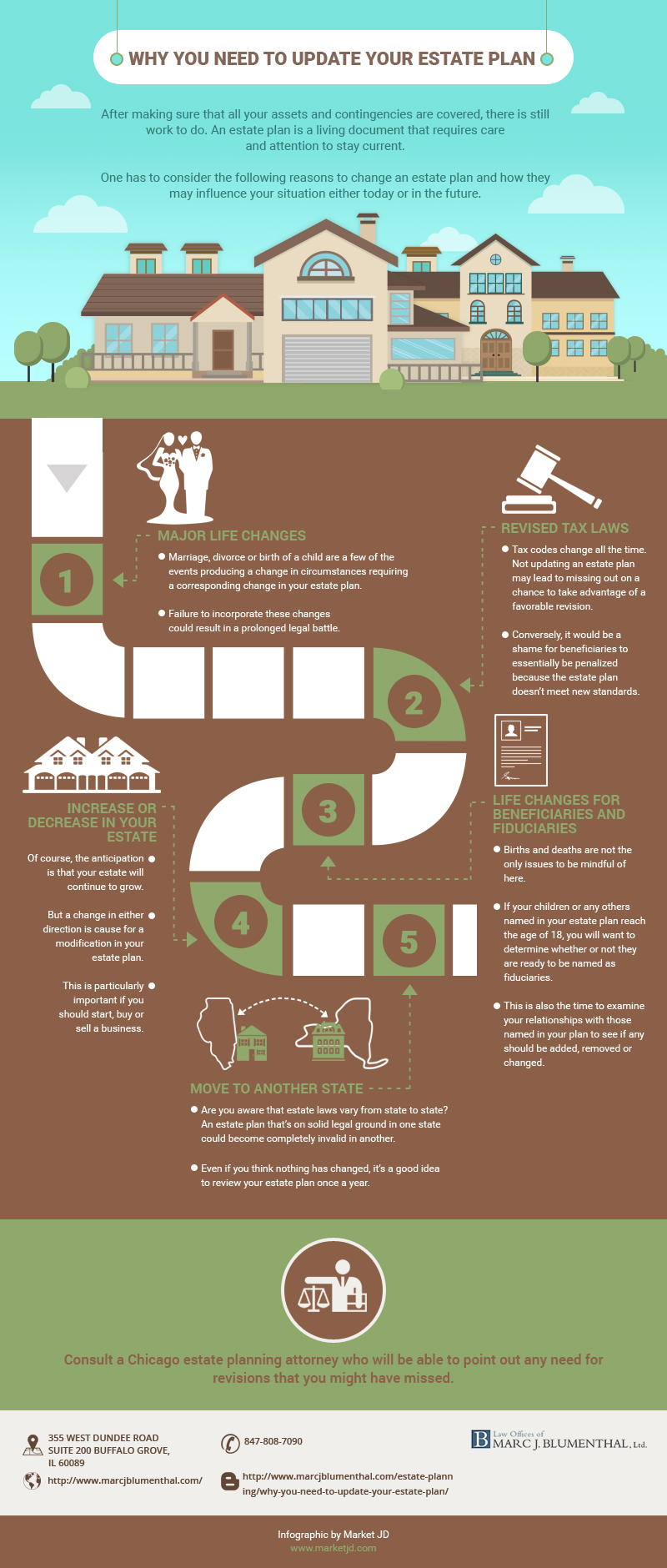

In reality, there is still work to do. An estate plan is a living document that requires care and attention to stay current. Consider these reasons to change your estate plan and how they apply to your situation, either today or in the future.

Major life changes

The most detailed estate plan is still only a snapshot of your situation at the time that it’s drawn up. But your life doesn’t stand still from that point. Marriage, divorce or birth of a child are a few of the events producing a change in circumstances requiring a corresponding change in your estate plan. Failure to incorporate these changes could result in a prolonged legal battle of the sort that you’re trying to avoid in the first place.

Revised tax laws

Tax codes change all the time. You don’t want to miss out on a chance to take advantage of a favorable revision. Conversely, you don’t want your beneficiaries to essentially be penalized because your estate plan doesn’t meet new standards.

Life changes for beneficiaries and fiduciaries

Births and deaths are not the only issues to be mindful of here. If your children or any others named in your estate plan reach the age of 18, you will want to determine whether or not they are ready to be named as fiduciaries. This is also the time to examine your relationships with those named in your plan to see if any should be added, removed or changed.

Increase or decrease in your estate

Of course, the anticipation is that your estate will continue to grow. But a change in either direction is cause for a modification in your estate plan. This is particularly important if you should start, buy or sell a business.

Move to another state

Are you aware that estate laws vary from state to state? An estate plan that’s on solid legal ground in one state could become completely invalid in another.

Even if you think nothing has changed, it’s a good idea to review your estate plan once a year. Consult a Chicago estate planning attorney who will be able to point out any need for revisions that you might have missed.